As Australia's only Air Freight specialist customs broker,

we provide unparalleled industry knowledge and experience.

Lowest Price Guarantee

As a specialist brokerage our pricing is highly competitive, but rest

assured if you find a cheaper comparative quote - We’ll beat it by 10%

How It Works

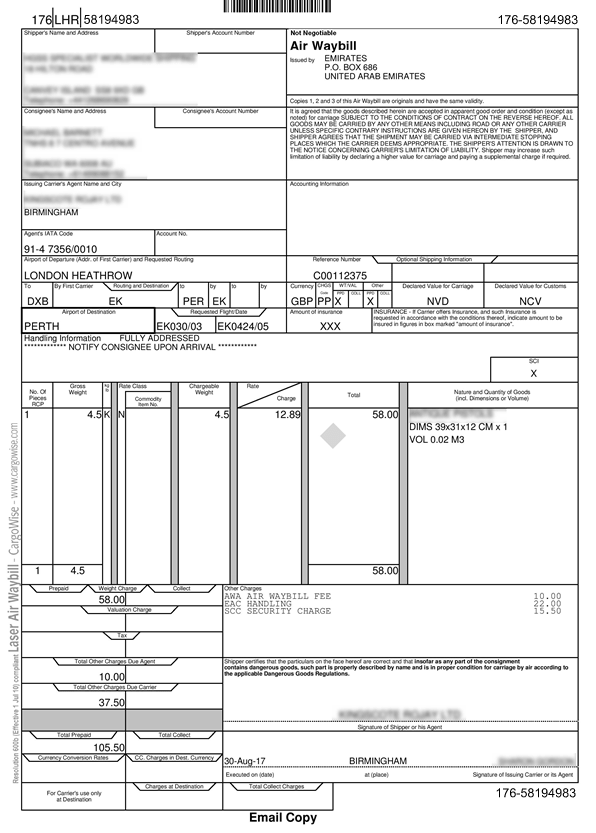

1. You Lodge Online - 5 mins

1. You Lodge Online - 5 mins

Complete a simple form to attach your

Air Waybill and your Suppliers Invoice.

Then you’re done!

2. We Customs Clear - 4hrs

2. We Customs Clear - 4hrs

We assess your goods to minimise

your Duty/GST payable, then

electronically lodge with Customs.

3. You Collect

3. You Collect

Once completed, we email you

all customs release documents

and full collection instructions.

Australia’s No. 1 Air Freight Customs Broker

What You Need

2Your Purchase Receipt or Invoice

Don't have an Invoice/Receipt?

If you don’t have a Customs accepted document

then you can create your own Personal Contents

Declaration (PCD).

A PCD is simply a document that

lists all the goods in your consignment

(download template ).

Then attach your completed PCD online in lieu of

a Suppliers Receipt or Invoice and you’re done.

What It Costs

Our Professional Fees | $150

Our Professional Fees | $150

All brokers are not the same. Our job is to work the

legislation in your favour, and there’s many avenues.

We clear over 83% of imports (12mth avg.) with zero

duty and/or GST applicable goods.

Customs & Government Fees

Customs & Government Fees

Airline Air Waybills (Direct Master AWB)

Import Terminal Fee: $0.528/kg (Min $52.80)

Import Document Fee: $53.90

Total Cost: $107.79 (Qantas rates ≤ 100kgs)

Freight Forwarder Air Waybills (Consolidated)

All freight forwarders have individual pricing,

typically 3-4 times the Airlines fees listed above.

Total Cost: $300-$400 (avg. for ≤ 100kgs)

*Excludes additional classified lines and 1.5% c/card surcharge applicable to all fees. Customs Clearance excludes GST.

Google Reviews - What Our Clients Say

Trusted by Corporations

With our air freight brokers, it’s personal.

As a niche Air Freight brokerage, we operate a little differently.

Our competitors typically offer dozens of industry related services in an attempt to

accommodate for every potential client, however we limit our focus in order to provide

clients with the highest possible knowledge and expertise in our chosen fields.

Developing personal relationships with key customs officers and airline bond (Qantas Freight, Menzies Aviation and Dnata) staff in

the Air Freight sector is critical to effectively protecting our clients’ interests, yet it’s

near impossible if you’re liaising with scores of different personnel in an attempt to

cover every base.

Many of our clients are personal importers - often for the first time - and our

appreciation of this fact is one of the reasons why we’re unique. Customs and

industry legislation can get quite complicated, so our focus is to communicate

client obligations in an easy to understand format, without all the mumbo jumbo.

We strongly believe in the importance of excellence in customer service. Which

means providing the right information the first time, so when you call us, you’ll be

speaking directly to a licensed customs broker because one will (almost) always

answer the phone, myself included.

So if you need an Air Freight customs agent, give us a call today and

experience the difference.

Greg Park

Customs BrokerManaging Director

Fully Licensed Customs Agents

Corporate: eCustoms Broker Pty Ltd is a fully licensed Customs Agent in accordance with Section 183CG of the Customs Act.

Corporate Licence No.: 01829C

ABN: 49 088 615 249

Personal: Individual Customs Brokers must also be personally licensed to lodge import declarations on behalf of clients. With 15 Yrs experience as a licensed customs broker, you're in safe hands.

My Personal Brokers Licence No.: 01545

Why use eCustoms Broker?

Air Freight Customs Clearance FAQ's

Yes. Formal customs clearance is required but we apply legislation to exempt you from the Duty, GST and Gov. entry fee.

The only additional requirement with consignments under AUD $1,000 is the you will also need to provide Evidence of Money Price Paid (EMPP) to validate the value of your consignment.

EMPP is any document that verifies the transfer of funds from your bank account to the suppliers account for the invoice value. Typical examples are PayPal or T/T receipts and Bank/Credit Card statements.

Yes. We can pre-clear your consignment as soon as it departs the origin.

We cannot however clear it prior to the date of origin flight departure as this is the valuation date of the consignment which determines customs exchange rates.

Once we’ve completed your customs clearance, you’ll receive a release email which contains the airline bond's collection address and contact details, which will typically be one of three companies, Qantas Freight, Menzies Aviation or Dnata. When you arrive, you should proceed to the reception office to pay your port charges and they will provide you with a collection docket.

You then take that docket to the pick-up dock and provide it to the forklift drivers and they’ll recover your consignment from the bond and load your collection vehicle.

Please note that if you’re bringing a car/van to collect your goods, the drivers will typically not hand load cargo for you, they will only fork it onto the ground beside your vehicle and you will need to break it down and load your vehicle.

Yes, they’ll usually start charging you storage 24hrs after midnight on the day of cargo check-in, which is usually completed within 6hrs of flight arrival.

Storage rates differ slightly between the three different airline bonds, but as a guide Qantas Freight charges $0.33/kg/day with a minimum of $48.40/day. Menzies Aviation and Dnata both charge based on volumetiric weight but Qantas Freight charges on actual.

They’re all open 7 days a week typically from 5am to 8pm Mon-Fri and 6am to 3pm weekends and public holidays, however the hours vary between bonds.

Qantas Freight lists their individual locations operating hours online, but Menzies Aviation and Dnata don't, therefore our release emails contain the collection bond's contact phone number so you can always give them a call if you need to collect outside of standard business hours.

That’s okay, just upload them all via the online form.

Depending on the circumstances, customs legislation may require a separate entry lodged for each supplier/consignee combination inter alia. Our brokers will evaluate your specific import circumstances and process your consignment in the most cost-effective manner that’s in accordance with legislative requirements.

An effective customs broker will save you time and money, usually more than you pay for the service. While using a customs broker to clear your imported goods is not mandatory, in most cases it’s certainly beneficial as outlined below.

SAVIVINGS: Customs brokers make sure you’re paying the minimum legally permitted amount of duty/GST for the specific transport circumstances and/or goods your importing. And there’s many avenues available for us to do this.

For example, in over 83% (avg.) of cases our postal import clients pay less to use us than they would by lodging the B374 - Import Declaration (N10) – Post form themselves.

TIME: Through electronic customs clearance processing, we facilitate significantly faster customs release timeframes than via manual self-lodgement of an import declaration.

To give you an example, we clear postal consignments in just 3hrs, whereas customs takes 8-10 business days to process self-lodgement documentation.

SIMPLICITY: With a customs broker, you provide your import documentation and they do the rest. With e-customs broker it’s even easier because you can submit all via our online portal in under 5 mins.

Self-lodgement requires you to complete the import declaration yourself, including applying the correct classifications and valuation of the transport/goods based on your particular importing situation.

LIABILITY: Using a customs broker also protects you from the risk of liability for lodging an incorrect N10 import declaration, which can be anything up to a $12,600 strict liability fine.

The bottom line is that if you’re not 100% confident that you clearly understand the legislation and the declaration your making in this regards, then you should use a customs broker.

Once cleared, you’ll receive a release email including full collection instructions. You simply follow the instructions in the email to collect your goods from the nominated bond, typically Qantas Freight, Menzies Aviation or Dnata.

You pay the port charges direct to the airline bond at the time of collection. If you’re arranging a courier, then you’ll need to either have the courier pay the charges on your behalf upon collection or call the bond to arrange pre-payment prior to sending your courier in.

Each bond has their own payment processes, but all will accept credit cards. The bonds contact details are provided to you in our release email upon completion of your customs clearance.

Due to insurance liabilities we don’t provide local delivery of consignments, however you can arrange a courier to collect them on your behalf if you wish.

Full collection instructions are provided to you in the release email we send to you upon completion of your customs clearance. If you’re using a courier, please also refer FAQ: How do I pay the airline port charges.

Australia's No. 1 Air Freight Customs Broker