Note: Harsh penalties apply for providing false or misleading information.

eBay Purchases

An eBay or Paypal email receipt that includes the eBay item number for every item purchased.

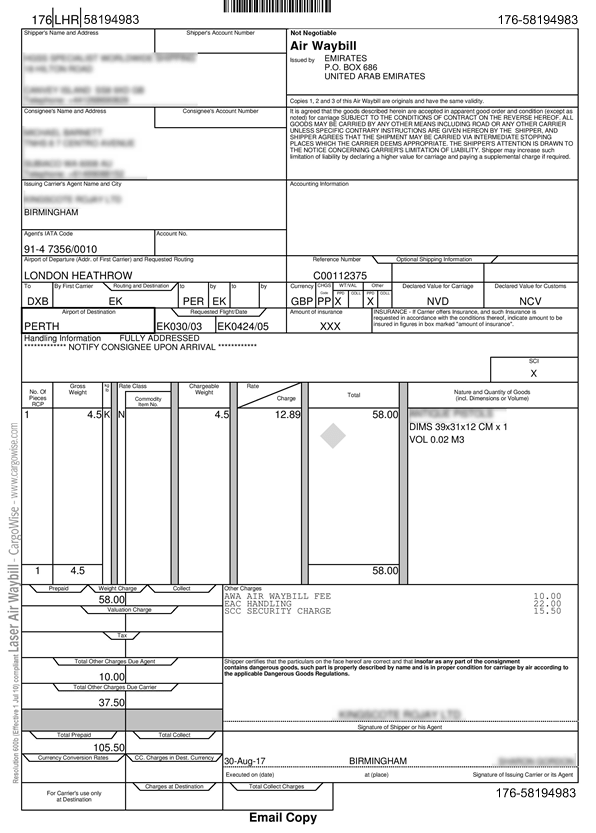

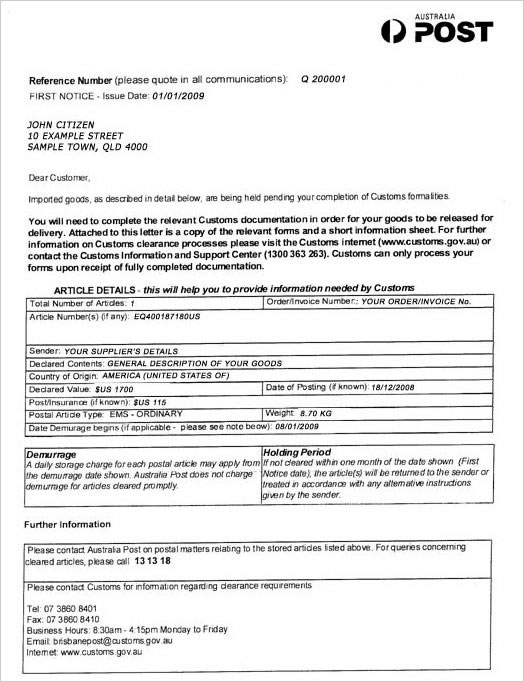

Purchases from Companies Overseas

Any of the below documents providing they contain the full description, quantity and value of every product in the consignment:

- Order confirmation

- Purchase order (including evidence of funds transfer)

- Arrangement emails (including evidence of funds transfer)

- Full commercial invoice

- Sales receipt

Note: Email versions of the above documents are acceptable providing they are forwarded as received and include the supplying company’s domain in their email address. (i.e. generic addresses such as Gmail, Yahoo, Hotmail and the like are not acceptable).

Acceptable Evidence of Funds Transfer: Paypal, bank transfers, EFT, credit card or bank account statements, POS register receipts.

Purchases from Individual’s Overseas

Any of the documents listed under Company Purchases above (if available); OR

A Personal Consignment Contents Declaration (download template), which is a signed document stating:

- The description, quantity and value of every product in the consignment; (generic descriptions such as “motorcycle engine parts” are NOT acceptable to Customs, all descriptions must be specific for each item in the consignment i.e. “motorcycle carburettor”, “paper gaskets”, “motorcycle engine camshaft”)

- The freight price you (or the sender) paid to send the goods to Australia;

- The name, address and contact email/phone no. of the sender.

You must also provide evidence of payment documentation to validate your declared values. (i.e. Paypal, bank transfers, EFT, credit card or bank account statements)

Unacceptable Commercial Documents

Generic Paypal receipts which do not list the description, quantity and value of every product in the consignment along with the suppliers address and freight cost.

- Summary Paypal receipts for the purchase of multiple products. I.e. $2000 of “Motorcycle Parts” or “Clothing”.

- Text or word documents without the suppliers letterhead or contact details.

- Any document that doesn’t clearly list the description, quantity and value of the products. i.e. Invoices with only model numbers but not actual product descriptions.