A Freight Forwarder's Most Closely Guarded Secret

...the Direct Master AWB.

As you're no doubt aware, air freight cargo passes though many hands on its journey from your supplier to you, but did you know that you can bypass one of the most expensive hands - the AU Freight Forwarder - with a simple supplier instruction and save yourself hundreds of dollars on every shipment?

We'll explain exactly how to do this, but first you'll need a little background.

The typical Air Freight cargo process flow:

In a nutshell

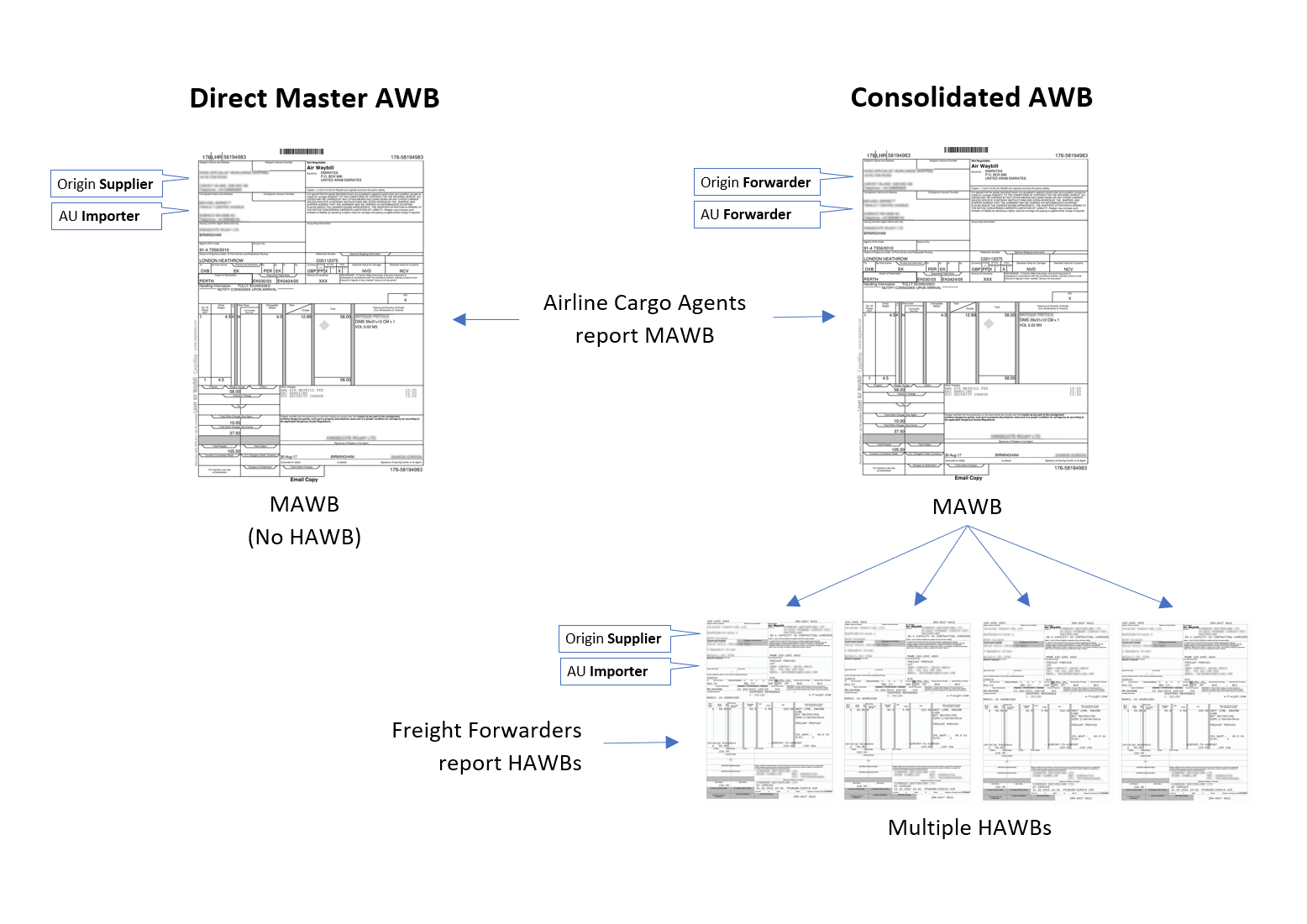

It’s all about how the Air Waybills (AWB) are cut at the origin. Most consignments travel as “consolidated cargo” which means the freight forwarder at the origin instructs the airlines to cut a Master Air Waybill (MAWB) that’s consigned from the origin forwarder to the AU forwarder.

Under that MAWB is one or more sub-bills, known as House Air Waybills (HAWB), which are cut by the origin forwarder and provided to the AU forwarder. Each HAWB is consigned from one overseas supplier to one Australian consignee. The HAWB is the AWB you receive from your forwarder.

To bypass the AU freight forwarder, you simply need to instruct your supplier to consign the goods accordingly, which is via what’s called a Direct Master Air Waybill. This is nothing more than a documentary instruction that removes the need for HAWB’s by listing you on the MAWB as the consignee, and your supplier as the consignor.

It doesn’t change the flights, freight rates, origin supplier/freight forwarder costs or anything else. The only practical difference occurs upon flight arrival in Australia. Because your listed as the consignee, the Airline Cargo Agents will notify you (or your appointed customs broker) directly, instead of the freight forwarder when your cargo arrives, voiding the need of their services.

What’s the benefit?

For a consignment ≤ 100kg, freight forwarders will charge you anywhere from $250 - $450 in port charges, but the airline bonds will only charge around $106 for exactly the same thing. Both airline cargo agents and forwarders charge based on per kg rates, so the larger your consignment, the more you’ll save with a Direct Master AWB.

In addition, you can also collect your cargo just 6hrs after flight arrival with a Direct Master AWB, as opposed to 1-2 days later with a freight forwarder.

Direct Master AWB Rates

Airline Cargo Agents fees for loose cargo, as is the case with a Direct Master AWB, are very competitive. Although they’re more than what your freight forwarder pays the airline cargo agents, they’re also considerably less than your freight forwarder charges you.

| Docs/Reporting Fee | Terminal Fees | Total ≤100kgs | ||

|---|---|---|---|---|

| Qantas | $54.00/AWB | $0.520/kg (Min $52.00) | $106.00 | Qantas Terminal Fees |

| Dnata | $52.55/AWB | $0.505/kg (Min $50.45) | $103.50 | Dnata Terminal Fees |

| Menzies | $54.00/AWB | $0.525/kg (Min $52.50) | $106.50 | Menzies Terminal Fees |

What’s the Catch?

If your customs broker is efficient, there isn’t one. This is because the airline cargo agents will only allow you one day of free storage following the date of flight arrival/check-in and a forwarder will typically give you 2-3 days. Storage rates thereafter are relatively similar, usually around $50/day for ≤ 100kg.

For our clients, the reduced storage free period isn’t an issue as we customs clear in 4hrs and usually while the goods are still in the air - providing they submit an online clearance request in a timely manner of course.

Apart from that, you simply collect your goods and pay the above port charges at the airline bond instead of the freight forwarder, which are usually both located in the same suburb. All else is identical from a client’s perspective.

One note of caution is for importers of quarantine-able goods, as quarantine processing delays can cause storage incursions that eat away at the financial benefits of direct masters, so it may not be the best solution for these commodities.

Just be mindful that once the goods depart the origin, you can’t change it from a Consolidated AWB to a Direct Master or vice versa. The simplest way to ensure it’s been done correctly is to request a copy of the AWB from your supplier before the cargo flys. If you’re listed as the consignee and it’s got the same 11-digit number (ignore any alphas) in the top right and top left corners, then it’s a Direct Master AWB.

How do I implement a Direct Master AWB?

By sending one email to your supplier advising them to instruct the origin freight forwarder to send your goods on a “Direct Master Air Waybill”. It’s that simple. All freight forwarders should know exactly how to consign a Direct Master AWB, it’s akin to asking your accountant “What’s an ABN?”. But if they have any problems, just direct them to this page.

What about Customs Clearance?

Once the cargo is booked to fly and your supplier sends you a copy of the AWB, you just liaise with your customs broker as you usually would.

If you don’t already have a customs broker or wish to utilise our 4hr service, then you can lodge a clearance request in 5mins online and we can clear it for you - you’ll need only to upload two documents, your AWB and suppliers’ invoice. We then pre-clear it, email you full flight arrival/collection details and you can arrange to collect the cargo 6hrs after the flight touches down.

Need More Info?

If you’ve got questions about the clearance and collection procedures, please refer our Air Freight Customs Clearance page, if you don’t find what you’re looking for there, you can peruse the Air Freight FAQs. If you’ve still got questions, give us a call on 1800 670 978 and speak to a licensed customs broker.

Interested in all the nuts and bolts? Okay, read on.

Breaking Down the Air Freight Process Flow

Origin Freight Forwarder

You can cut out this set of hands but it’s generally not of any significant financial benefit because the airlines will charge considerably higher rates to irregular supplier booked consignments than they will to weekly freight forwarder account cargo.

In addition, most suppliers would prefer to simply instruct a freight forwarder to “send it” rather than dealing with all the necessary export compliance procedures, especially when there’s no financial benefit to them in doing so.

Airlines

You can shop around to obtain better air freight rates, however there’s an increased risk that accompanies a great freight rate. The less you pay, the higher the probability that your cargo will be the one that’s bumped at the last minute to accommodate either excess passenger baggage (which occurs quite regularly) or a higher per kilo paying freight consignments.

It’s simply not good business for the airlines to accommodate low rate cargo when there’s higher paying exporters (passenger baggage pays the most) seeking that same aircraft belly space. This is how “Next Flight” services operate, they pay high rates to get their cargo boarded at short notice, and the low rate cargo gets bumped.

Airlines provide themselves exclusive rights in their T&C’s to bump your cargo as many times as they wish and for any reason they choose. You can complain, but unless your cargo is being repeatedly bumped, it will likely fall on deaf ears.

AU Airline Cargo Handling Agents

The international air freight rates you pay terminate when the aircraft touches down with your goods in the belly of the plane out on the tarmac. Therefore, airline cargo handling agents are appointed by the airlines as responsible for unloading aircraft and reporting the arriving consignments at the MAWB level to Customs.

In Australia, there are three airline cargo agents (Qantas Freight, Menzies Aviation and Dnata) in every capital city that handle the air freight cargo for all international airlines and their prices are almost identical.

AU Freight Forwarder

They pick-up your cargo from the cargo handling agent upon flight arrival and move it back to their bond, usually a few kilometres away. They then sub-report your cargo to customs in accordance with the HAWB’s they’ve received from the origin forwarder.

If you're a bit confused with all the acronyms and industry terms that freight forwarder throw around, we can clear the waters for you - refer Freight Forwarder Invoicing and Charges Explained to find out what you're really paying for.

Customs Brokers

This is where we come in, you can customs clear the goods yourself however most importers choose to use a customs broker as they don’t wish to navigate the necessary legislation to achieve an optimal financial result that’s legally compliant. The manual process also requires you to attend a customs office at least twice, once to submit your manual declaration, then again (once they’ve processed it, typically the next day) to answer the declaration questions and pay the duty/GST.

Essentially, customs brokers operate on a similar principle as accountants, you can do your own tax, but if you use an accountant you should benefit more in time, money and reduced risk of penalty than you’re paying them to do it - which is also the case with customs brokers.

There are many concessions in the legislation and our job is to ensure that the specific products and circumstances of your importation are being leveraged in your favour to the maximum extent permissible by law.

Airline Cargo Agent Collections

When you lodge via our online portal, once we’ve completed your customs clearance, you’ll receive a release email that contains the airline bonds collection address and contact details. The collection process is similar to freight forwarders, when you arrive, you should proceed to the reception office to pay your port charges and they will provide you with a collection docket.

You then take that docket to the pick-up dock and provide it to the forklift drivers and they’ll recover your consignment from the bond and load your vehicle. You can arrange a courier to collect the goods on your behalf if you wish, however just as it is with forwarders, you’ll need to make sure you call the bond beforehand to pay your port charges via credit card.

One point to be aware of is that because the airlines don’t have appointments or collection slots like the wharf, we recommend clients arrive late afternoon (typically after 3pm) and you’ll walk in and out very quickly. If you arrive earlier you may find yourself in a queue to be loaded, however most congestion has dispersed by mid-afternoon.

eCustoms Broker - The Air Freight & Postal Specialists