As Australia's first postal specialist customs broker,

we've been pioneering the industry for over 10 years.

Lowest Price Guarantee

Our pricing is highly competitive, but rest assured if you find a

cheaper comparative quote - We’ll beat any price by 10%

How It Works

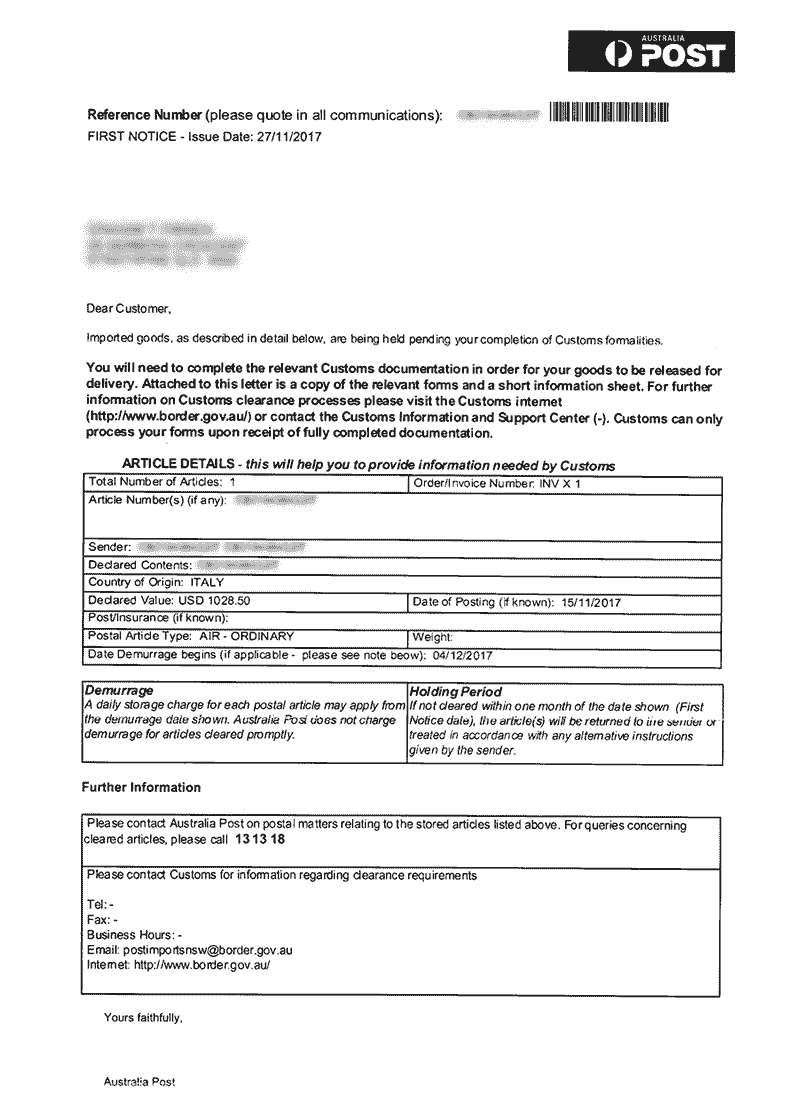

1. You Lodge Online - 5 mins

1. You Lodge Online - 5 mins

Complete a simple form to attach

your customs notice and your

purchase receipt. You're done!

2. We Customs Clear - 3hrs

2. We Customs Clear - 3hrs

We assess your goods to minimise

your Duty/GST payable, and then

electronically lodge with Customs.

3. Australia Post Delivers

3. Australia Post Delivers

We notify you by email and

Australia Post delivers to your

door. It's that simple.

Australia’s No. 1 Postal Customs Broker

What You Need

2Your Purchase Receipt or Invoice

No Purchase Receipt or Invoice? No Problem

If you don’t have a Customs accepted document

then you can create your own Personal Contents

Declaration (PCD).

A PCD is a specifically formatted document that

lists all the goods in your consignment

(download template ).

Then attach your completed PCD online in lieu of

a purchase receipt/invoice and you’re done.

What It Costs

Customs Clearance Options

Customs Clearance Options

- 24hr Standard Service | $70

- 3hr Priority Service | $120

All brokers are not the same. Our job is to

work the legislation in your favour, and

there’s many avenues to do this.

Customs & Government Fees

Customs & Government Fees

- 5% Customs Duty + 10% GST

- $50 Processing/Gov. Entry Fee

Duty and/or GST exemptions may apply.

We clear over 83% of imports (12mth avg.)

with zero duty and/or GST applicable goods.

*Excludes any additional classified lines and 1.5% c/card surcharge applicable to all fees. Clearance fees exclude GST.

Google Reviews - What Our Clients Say

Trusted by Corporations

With our brokers, it’s personal.

As niche Australia Post broker, we operate quite differently to the competition.

Most offer dozens of customs/importing related services in an attempt to cover every potential client, however we narrow our focus to provide international postal clients with the highest possible knowledge and expertise in this import sector.

This is important because postal customs clearances are quite a different process to general air or sea freight cargo clearances, with specific legislation that exclusively applies to the postal environment.

Most commonly we see other brokers failing to apply correct postal entry parameters, resulting in your parcel's unique customs identifier being omitted from the auto-generated release report, hence your goods indefinitely sit in the Australia Post bond.

Many of our clients are personal importers - often for the first time - and our understanding of this fact is another aspect of what sets us apart. Customs legislation can get complicated, so we focus on communicating it to clients in easy to understand plain English without all the industry mumbo jumbo.

Furthermore, we provide direct broker access, something that’s almost unheard of in the industry, especially for personal importers. But when you call us, you’ll speak directly to a licensed broker because one will (almost) always answer the phone, myself included.

I believe the above provides our clients with an exceptional customer service excellence. So if you need a customs agent for an international postal consignment, give us a call today and experience the difference.

Greg Park

Senior Customs BrokerClient Services

Fully Licensed Customs Agents

Corporate: eCustoms Broker Pty Ltd is a fully licensed Customs Agent in accordance with Section 183CG of the Customs Act.

Corporate Licence No.: 01829C

ABN: 49 088 615 249

Personal: Individual Customs Brokers must also be personally licensed to lodge import declarations on behalf of clients. With 15 Yrs experience as a licensed customs broker, you're in safe hands.

My Personal Brokers Licence No.: 01545

Why use eCustoms Brokers?

Australia Post Customs Clearance - Most Common FAQ's

Your customs reference is a unique identifier of your parcel in the customs systems, hence it’s a mandatory requirement of customs clearance.

If you haven’t received the customs letter in the mail, then you can call customs on 131 881 (option 5, then 1) and request your Customs Reference, which will be a letter followed by six numbers - e.g. N123456.

Once received, you can submit a customs clearance request online, just select I did not receive this notice when you’re prompted to provide your Customs Notice.

Yes. This is a common scenario. We clear consignments electronically, therefore when Customs attempt to process your manually submitted N10I Import Dec, they will see that it’s already been cleared by a broker and disregard your documentation.

In a worst-case scenario, if they miss to realise this and also process it, they will send you an email and at that point you need only to reply with “It’s been cleared by a broker, please disregard” and they will do so at that time. You don’t need to pay duty/GST twice.

No, because we need your unique Customs Reference that’s associated to your consignment to clear your goods. This number will appear on the Australia Post / Customs Notice you receive in the mail.

If the tracking shows that your consignment has arrived but you haven’t received this letter in the mail, please follow the steps in the above FAQ 'What if I don't have the Customs Reference?'.

Gift are treated no differently to commercial consignments, the law requires that all goods, even gifts, over the value of AUD$1000 are subject to the assessment of customs duty and GST and checked for community protection risks. The value of a gift is assessed as the usual value that you would buy that item for in the country of origin.

Yes. The law requires that all goods – whether second hand or new, commercial or private – be subject to the assessment of customs duty and GST and checked for community protection risks.

Duty and/or GST is only collected on imported goods where the value of the goods is above A$1000, OR where the goods include alcohol, tobacco or are prohibited/restricted products. Goods valued above A$1000 must be cleared through Customs by completion of a formal Customs Entry.

If you have received a Customs Notice then the shipper has already advised customs that your goods meet these criteria.

No. Customs only “pauses” your original delivery contact with the supplier, they don’t terminate it and initiate a new one, hence your goods will continue to be delivered in accordance with the original service level contract with which they were sent from the origin.

If you’re not home and your parcel requires a signature, then Australia Post will leave a yellow card in your letterbox and you will need to attend the post office nominated on the card to collect your consignment.

A good customs broker will save you time and money, typically more than you pay them. While it’s not mandatory to use a customs broker to clear your imported goods, in most cases it’s certainly beneficial as outlined below.

SAVINGS: Customs brokers work to ensure you’re paying the least amount of duty/GST that’s legislatively permitted for the specific circumstances of your importation. And there’s many avenues available for us to do this.

For example, over 83% (avg.) of our postal import clients pay less to use us than self-lodgement of a N10/B374 - Import Declaration (N10) – Post form.

TIME: We provide electronic customs clearance processing which is significantly faster than self-lodgement of an import declaration as this is a manual documentary process.

For example, we clear postal consignments in just 3hrs, but self- lodgement takes customs 8-10 business days to process.

SIMPLICITY: With a customs broker, you simply provide your import documentation and they do the rest. With e-customs broker it’s even easier as you can submit online in just 5mins.

Self-lodgement requires you to complete the import declaration yourself, including applying the correct valuation and classifications of the goods based on your specific import circumstances.

LIABILITY: Using a customs broker also protects you from the risk of liability for lodging an erroneous import declaration, which can be anything up to a $12,000 strict liability fine.

The bottom line is that if you’re not 100% confident that you understand the legislation and know exactly what your lodging in your declaration, then you should use a customs broker.

Once you receive the release emails from us your consignment is “Customs Cleared” and our servers automatically notify Customs of the release. Customs then generates a release report at midnight on the day of clearance which is transmitted to Australia Post at 9am the next morning.

From this point Australia Post officers take your consignment out of the customs held facility and put it back in their general delivery cycle, and they quote 1-7 business days for delivery based on the service level the goods were sent from the origin on.

Tracking after Customs Clearance: The international tracking system will NOT change but remain as “Held in Customs” until your consignment physically leaves the Australia Post bond.

It’s up to Australia Post when they actually schedule this to occur as they are only bound to deliver your consignment within 7 business days, therefore the exact day when they commence this process after clearance notification (as outlined above) is at their discretion.

It’s not uncommon that the international tracking doesn’t change for anywhere up to 3-4 business days depending on the service level that the goods were posted on as Australia Post prioritises express consignments over standard ones.

If you haven’t received the consignment within Australia Posts 7 business day delivery window then you can call them on 13 13 18 and quote your 13-digit tracking number to ascertain the progress of your delivery.

Yes. You use the same 13-digit international tracking number to track your consignments local delivery progress, however this is updated from the origin provider (and occasionally duplicated in Australia Post tracking) therefore the accuracy of such information is dependent on the origin carrier.

Please Note: Until your consignment physically leaves the Australia Post bond, the international tracking system will NOT change but remain as “Held in Customs” even though we’ve already cleared your consignment. Please refer the “What Happens After Customs Clearance” FAQ for full information regarding this process and tracking statuses.

The International Postal Specialists